GME Stock in 2021: The GameStop Saga and the Power of Retail Investors

Introduction: The year 2021 witnessed an unprecedented event in the financial markets, centered around GameStop (GME) stock. This article delves into the captivating story of GME stock, exploring the role of retail investors, the short squeeze phenomenon, the impact on traditional financial markets, and the future of GME and retail investor activism.

Introduction to GameStop (GME) and its Background

GameStop’s History and Business Model: GameStop, a retail company specializing in video games and electronics, faced significant challenges due to the digital transformation of the gaming industry. This section provides an overview of GameStop’s business model, its struggles in the face of online competition, and its position in the market before the events of 2021.

GameStop’s Business Model and Challenges Faced

The Rise of Digital Distribution: GameStop’s business model heavily relied on physical game sales, which faced increasing competition from digital distribution platforms. This section discusses the challenges GameStop encountered as digital sales surged, leading to declining revenue and store closures.

The Rise of the Retail Investor Movement

The Emergence of Retail Investor Activism: The GameStop saga showcased the growing power of retail investors, who organized themselves through online communities and social media platforms. This section explores the factors that contributed to the rise of retail investor activism and their impact on stock market dynamics.

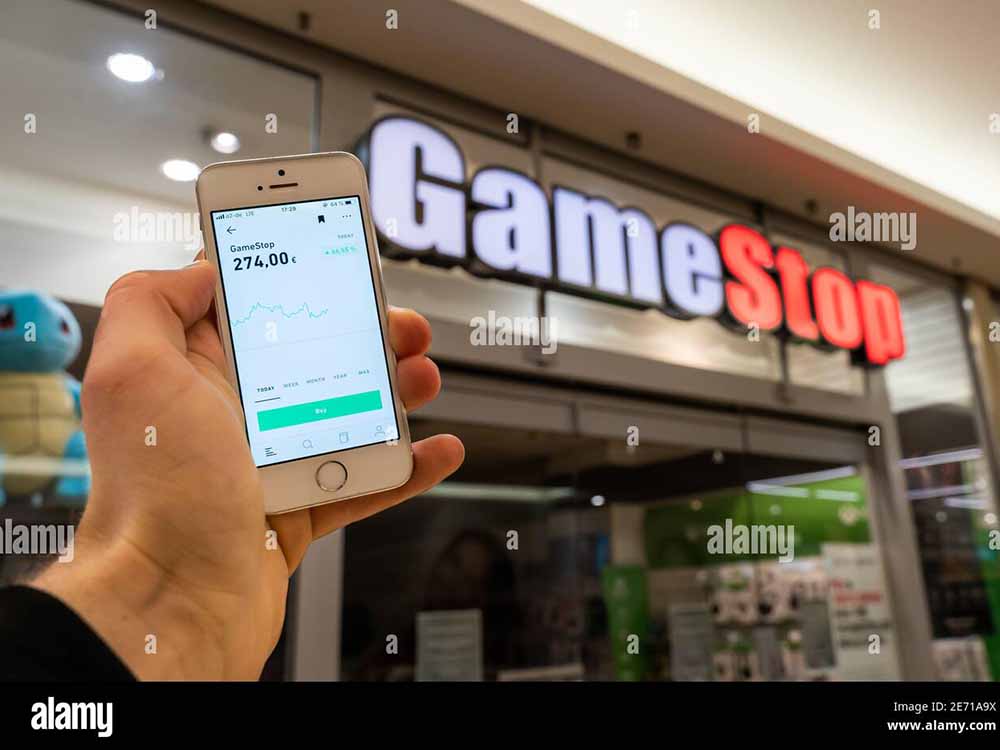

The Short Squeeze Phenomenon and GME’s Soaring Stock Price

Understanding the Short Squeeze: A key element of the GameStop saga was the short squeeze, where retail investors collectively bought GME stock, causing its price to surge. This section explains the mechanics of a short squeeze, the role of short sellers, and how it led to an extraordinary rise in GME’s stock price.